https://video.fc2.com/content/20220823nbcPZsPD

https://www.fujitsu.com/jp/about/resources/case-studies/trends/cs-201707-lottecard.html

https://www.fujitsu.com/jp/about/resources/case-studies/trends/cs-201707-lottecard.html

LOTTE CARD

Safe and Convenient Payment Solution Leading the Korean Financial Industry by Realizing "Shopping with No Money in Hand" through the Use of Palm Vein Authentication

In South Korea, the government is promoting the revitalization of the Fintech industry as a national policy. On the other hand, in light of the large-scale credit card information leakage incident, users (citizens) are demanding secure mechanisms such as biometric authentication. LOTTE CARD has therefore established the "HandPay Payment Service" employing Fujitsu's "palm vein authentication" solution to provide a new shopping style that does not require a credit card or mobile terminal for payment. The company has launched a cutting-edge Fintech service ahead of its competitors, aiming to improve convenience for users and establish its position as a leader in the Korean financial industry.

ChallengeTo provide an unprecedented, secure, and convenient payment mechanism

EffectA new service that allows credit card users to shop "without any credit card".

The client wanted to differentiate itself from its competitors and take a leadership position in the financial industry.

EffectAhead of competitors in the Korean Fintech business by adopting palm vein authentication

Background of Introduction

Background of Introduction

Key Points of Introduction

Effectiveness and Future Prospects

Background of Introduction

National government promotes activation of the Fintech field

Secure, non-personal identity authentication has become indispensable

In South Korea, mobile financial services are rapidly expanding as a result of government policies aimed at stimulating the Fintech sector. Services such as e-payments using biometrics have also increased, with some 90,000 new jobs created in the Fintech sector. The biometric authentication market also grew to 300 billion won in 2016, double the size of 2012.

Against this backdrop, LOTTE CARD wanted to differentiate itself from its competitors by providing credit card users with a secure and convenient service. The company launched the "HandPay Payment Service," which allows customers to make payments without a credit card, simply by authenticating the vein in the palm of their hand. Until now, there has been no service that uses biometrics to perform everything from identity authentication to credit card payment.

For this reason, LOTTE CARD has adopted Fujitsu's "palm vein authentication" solution. Mr. Park, Managing Director of LOTTE CARD's Marketing Head Office, said, "LOTTE Group is a company that is taking on the challenge of introducing new technologies ahead of its competitors. The Lotte Group is a company that takes on the challenge of introducing new technology ahead of its competitors. We are not the No. 1 credit card company in Korea, but we are taking the lead in adopting artificial intelligence (AI) and big data analysis, and we want to become the leader in financial services using advanced technology in Korea," said Mr. Park Doo-hwan, Managing Director of LOTTE CARD's Marketing Head Office, in sharing his vision.

Mr. Park Doo-hwan

Managing Director

Marketing Head Office

LOTTE CARD

Mr. Kim Byung-jun

Head of Digital Payment Team

Digital Payment Team

LOTTE CARD

Background of Introduction

Palm vein" is one of the strongest biometric authentication methods

Supported by a proven track record in Korea

Compared to fingerprint authentication, authentication using veins in the palm of the hand has an overwhelmingly low risk of being forged. Fingerprints remain on the surface of the body, so they remain on objects that are touched, and with the increased resolution of the cameras in smartphones these days, there have even been cases where fingerprints have been recovered from photos posted on blogs and the like. Authentication using the face or iris is also susceptible to forgery because it uses information obtained from the surface of the body.

In this respect, veins are located inside the body, and even a specific component of the body called reduced hemoglobin in the blood vessels is read as personal information for authentication. For this reason, the risk of forgery is said to be close to zero. The veins in the palm of the hand are numerous and complex in shape, and the amount of information that can be read is large, making it safer than other biometric authentication technologies, with an acceptance rate of 0.00008% for others and 0.01% for the individual. The use of palm vein authentication also provides high protection against card fraud due to skimming and fraudulent impersonation of others.

Fujitsu has experience in Korea, having installed a palm vein authentication system at Shinhan Bank and a biometric authentication system at the Biometric Information Decentralized Management Center of the Korea Financial Settlement Center (KFTC), which uses this infrastructure system to provide services to support the introduction and operation of biometric authentication at financial institutions. This track record in Korea and the availability of KFTC's services were factors that encouraged LOTTE CARD to adopt the palm vein authentication system.

Key Points of Introduction

Settlement can be completed using only palm vein information.

Integration with existing payment systems and other systems is also being considered.

To perform palm vein authentication, near-infrared rays are uniformly applied to the entire palm of the hand to capture the vein vessels, which are then compared to the registered data. In the contactless palm vein authentication system developed by Fujitsu, the blood vessel information can be read simply by holding the user's hand over the sensor surface of the authentication terminal, without the user having to directly touch it. This has the advantage of being hygienic even in environments where an unspecified number of people use the system. In practice, it is difficult to control the non-contact, uniform application of near-infrared light to the palm of the hand. Fujitsu overcame this challenge by applying scanning technology cultivated in various fields.

PalmSecure™," a palm vein authentication device, enables payment by simply holding up the palm of the hand.

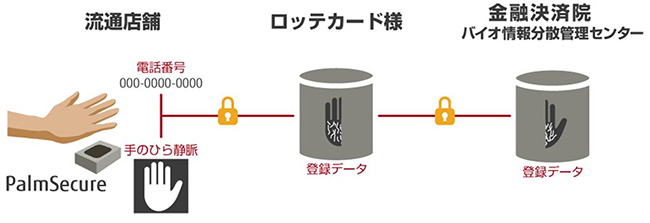

Users of the HandPay payment service initiated by LOTTE CARD first scan and register their vein biometric information at the card center. The scanned vein pattern information is linked to the individual's credit card information on the biometric authentication server. The vein pattern information is converted into unreadable data, which is then distributed and managed by LOTTE CARD and KFTC.

When paying at the cash register, the registered user enters his/her cell phone number into the payment terminal and holds his/her palm over the scanner. The vein pattern information is checked against the credit card information on the biometric authentication server. The payment is completed upon confirmation of authorization. Users do not need to carry a wallet, credit card, or even a mobile device such as a cell phone or smartphone to make payments.

Benefits and Future Prospects

Aiming for "empty-handed shopping

A new experience from Korea to the world

LOTTE CARD first introduced the HandPay payment service to an unmanned 7-Eleven store in Lotte World Tower. In the future, the company plans to link the service to existing payment systems and POS terminals in stores, and expand it to stores affiliated with the Lotte Group.

Mr. Kim, Head of Smart Business Team at Lotte Card, commented, "Fujitsu understood the regulations and environment unique to South Korea and responded to our request with their rich experience and high technological capabilities. We look forward to Fujitsu's active collaboration with us to expand the market for this service in Korea," he said.

Mr. Kim said that the most important aspect of a credit card company's service is customer convenience, "LOTTE CARD allows customers to shop without carrying a wallet or even a credit card," he added. LOTTE CARD offers a whole new way of shopping, allowing customers to shop without even carrying a wallet or credit card. We are confident that our radical approach will create a sense of security for our customers," he said.

Fujitsu's technology, validated in the Japanese market, meets the distribution and financial infrastructure of the Lotte Group in Korea to create a new service for the future. The new shopping style using palm vein authentication solutions has the potential to spread around the world, starting with Korea.

Click here to read the rest of the article, including key points of the introduction.

Palm Vein Authentication Enables "Shopping with No Money in Your Hands

Safe and Convenient Payment Solution Leading the Korean Financial Industry

Download PDF document

Related Products, Services and Solutions

Palm Vein Authentication FUJITSU PalmSecure™ Biometric Authentication

Related Links

Providing palm vein authentication devices to the Korean payment market

LOTTE CARD

Business Field Credit-specialized finance business (credit card business, installment payment finance business)

Business scale Total assets (FY2016): 10.2 trillion KRW (consolidated financial basis)

Net income 141.6 billion KRW (FY2016)

Number of offices 18 locations

Number of employees 1,704

Year of establishment December 3, 2002

[Published in July 2017]

Inquiries about this case study

Inquiry via Web

Go to the input form

We use SSL technology for security protection.

Inquiry by phone

Fujitsu Contact Line (General Contact)

0120-933-200 (toll free)

Hours: Weekdays 9:00 - 17:30 (except Saturdays, Sundays, national holidays, and company-designated holidays)

0 コメント:

コメントを投稿